Managing money as a student and managing finances as a young working adult can be two completely different ball games.

But it is something we all have to contend with as we go through #adulting.

Whether you’re scared, confused or even excited about the prospects of managing your own wealth – you’re not alone.

Meet Christina, who was once so intimidated by a financial consultant at the bank that she signed herself up for a savings plan even though all she wanted to do was to open a bank account.

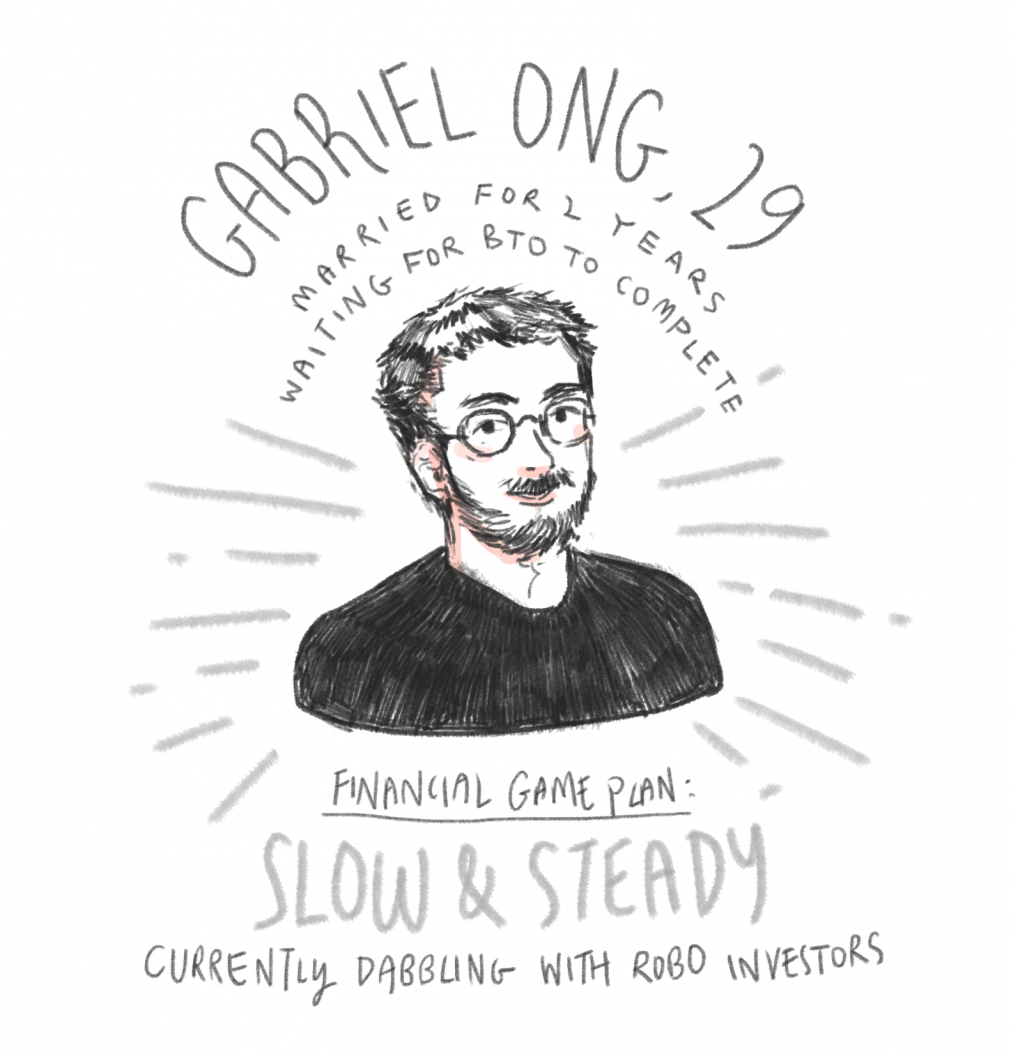

We also have Gabriel, whose financial planning was “complete chaos” as a student.

His wake-up call only happened when it dawned upon him that he had a wedding and a build-to-order (BTO) on the horizon to fund.

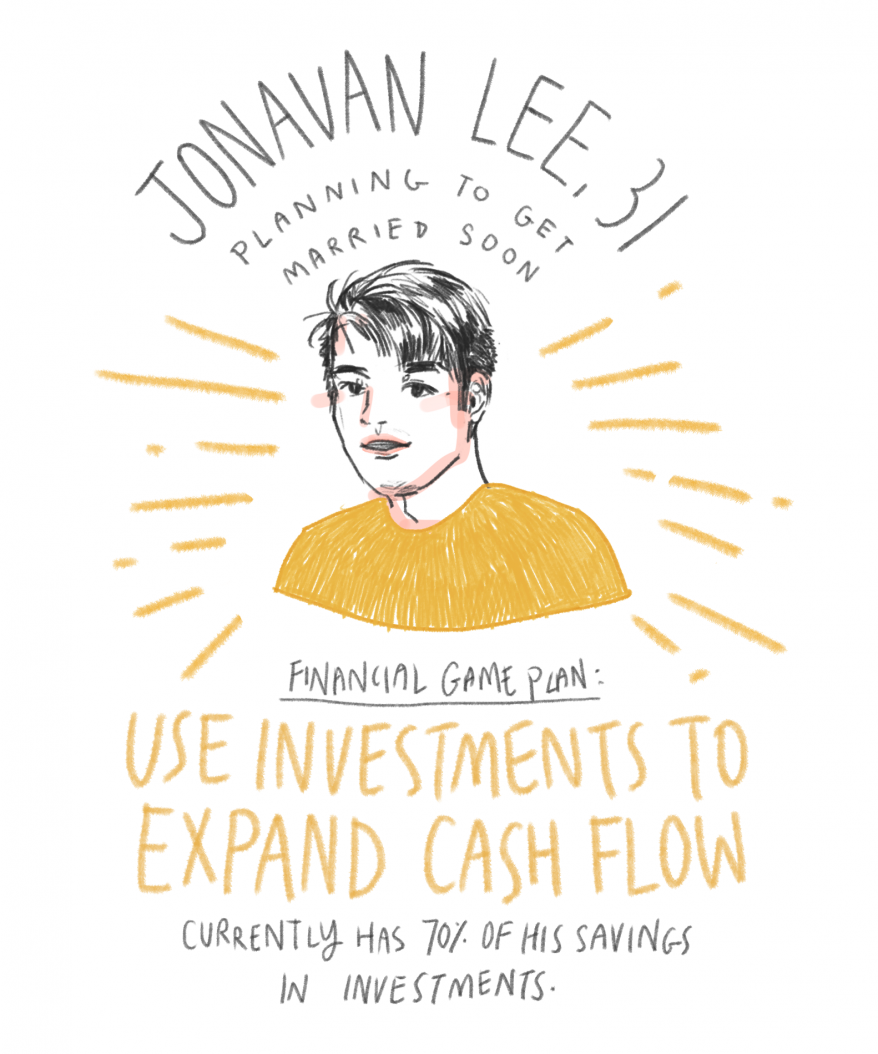

Lastly, we have Jonavan Lee, who was prudent even as a student.

By his second year into the workforce, he managed to save up a substantial amount and decided to take his financial management to the next level – the stock market.

Read on to find out how they started on their financial journey and developed a strategy that works for them.

FIRST STEPS

There are many ways to manage finances. Saving up, insurance, investment and even maximising one’s credit card usage can be a part of your game plan in managing finances.

For Jonavan, keeping a healthy cash flow and having insurance coverage are fundamental.

He explained: “Hospitalisation, accident and cancer insurance is a must. You never know when it’ll hit. And when it hits, you’ll lose your ability to make money.”

This is also why he recommends setting aside at least three months worth of expenditure as cash flow savings. Only after he had his bases covered did Jonavan begin investing.

“Don’t let your money lie idle and invest what you can afford to lose,” he encouraged. “The Bible talks about good stewardship of money in the parable of the talents in Matthew 25:14-30.

“We shouldn’t bury our money – we should make it work for us.”

However, he also cautioned that everyone should do their due diligence when it comes to investing.

“I read up on investing and watched a lot of YouTube videos. I also went to SGX finance talks and events. I became a premium member of The Motley Fool which has been revamped to The Smart Investor,” Jonavan shared.

“I subscribed to Growth Investors, The Singaporean Investor, Financial Horse, The Fifth Person and Seedly Finance,” he added.

Jonavan shared that his current financial game plan is to invest as much as possible and get the most returns while not yet bogged down by housing loans, renovation and children expenses.

Everyone should do their due diligence when it comes to investing.

Understanding his upcoming needs such as a proposal, wedding and housing also motivates him to increase his cash flow through dividend investing and growth investing.

Other ways include utilising credit cards for rewards and cashback.

“Some cards are good for groceries, some are good for dining. Spend within your means and allocate the right spending to the right credit cards,” Jonavan advised.

While Jonavan’s game plan sounds enticing, it requires a high level of discipline and financial knowledge. That is something he has cultivated over years.

So, what if you’re a complete novice and all this sounds too challenging? Gabriel offers a simpler strategy.

As a beginner, Gabriel’s first step towards financial management was to understand what was “coming in and going out financially”.

This was a baby step, for someone who did not keep track of his finances in his student days!

But in light of marriage – and a BTO on the way – he had to learn.

Starting with a jotter book, Gabriel has since upgraded to an app to keep track of his finances. He updates his spending religiously and is able to get an overview of his monthly spending.

With a better grasp of his expenditure, Gabriel shared that he can now plan for his future more effectively – this includes setting his financial goals and understanding what it will take to reach those plans.

Looking back on his student days, Gabriel realised how unfaithful he had been with the little he had.

“When I understood the biblical principle of faithful with little, faithful with much, I started taking steps to steward my finances such as making sure I could faithfully tithe and give to others.”

To improve his financial management skills, Gabriel also spoke to friends, watched seminars and read online forum discussions.

“A church friend has helped me settle my insurance needs so I’m fully covered. He’s also helping me a little on the investment side,” Gabriel revealed.

Gabriel shared that he has begun to dip his toes into the waters of investing.

“I’m still reading and learning, but as of right now, based on my passive personality and risk profile, I’ve decided on beginning my own investment journey through a robo-advisor,” he said.

For Christina, her priorities and risk appetite are slightly different due to her circumstances.

“I’ve seen relatives go through really challenging times because they were too deep into share trading and investments despite losing a lot of money. Some have lost their houses and cars due to debts.

“So to have grown up watching that, I think that has really shaped how I view money.”

Besides being scarred by negative experiences, Christina is also the sole breadwinner of her family. This means having to channel most of her income into daily expenses.

She is thus very cautious with the money that remains, preferring to opt for a safer route.

“Lately my friends have been talking to me about robo-advisors and investments,” Christina shared. “I’m still on the fence about this – mainly due to the existing financial responsibilities I have at the moment.”

With a smaller risk appetite and a tighter budget, Christina tries to make the best out of what she has while playing it safe.

To do so, she has multiple bank accounts to set aside her daily expenditure and rainy day funds.

“I look for the best savings accounts for long-term savings and maximise benefits through smaller things like interest rates.”

However, interest rates do fluctuate at times which happened a lot in the past year due to the pandemic.

“I always tell myself that the added benefits were not mine to begin with,” she elaborated. “That makes it a lot easier for me to process the emotions when the banks decide to cut the interest rates.”

Christina also chose not to sign up for credit cards.

She explained, “I know there are quite a lot of tiers of benefits to credit cards, but I decided I would stick to debit cards to watchfully keep my finances in line.”

STEWARDSHIP OR GREED?

While the three profiles have very different financial management styles, all of them shared the same concern with me.

How do you draw the line between greed and stewardship?

For Jonavan, he measures it by the peace he experiences – or the lack of – when it comes to his investments.

“When you’re playing with margins or borrowing money to invest, or when you’re too fearful, can’t sleep and stress over your financial future when the prices drop, that’s when you know greed has started to seep in,” he said.

“We’re just fund managers of the money that God gave us.”

He added: “In the midst of being good stewards of money, we might get carried away and become obsessed with money.”

What helps Jonavan stay grounded is 1 Chronicles 29:12, which helps him remember that “nothing is ours”.

“Like how an investment banker might check with his client (money-giver) before performing a large trade, so we should also check back with our money-giver, God, before making any huge investment decision,” said Jonavan.

“We’re just fund managers of the money that God gave us.”

While Gabriel shared that he would like to one day try investing on his own rather than rely on robo-advisors, he is unsure if that is the best practice for him now.

“One thing that held me back in this journey was that I found myself becoming a bit too obsessed when I was more active in monitoring trends and news,” he revealed.

It was a fixation that would quite quickly bleed into greed.

“Maybe that might change as I learn more and become wiser financially,” continued Gabriel. “But as of now, I feel I’m emotionally and spiritually better off simply by setting aside a fixed sum into my robo-investments monthly.”

While Christina doesn’t dabble in the stock market, it doesn’t mean that greed doesn’t creep into her life.

“I used to be very obsessed about every cent going in and out of my accounts, to the point that I would check my balances multiple times a day,” she admitted.

This was a result of childhood experiences where familial relations had been strained over financial matters.

“As a child, seeing that, I learnt that money was a powerful thing – but it led to my obsession with it,” she explained. “For example, if I was feeling stressed out about finances, I would easily lose control of my temper and snap.”

“At the moment, I think that my curiosity to know more is merely fueled by the desire to have more.”

These days, Christina has learnt to be “quite chill” when it comes to money. She doesn’t check her account to see how much she has, but only to make sure she has not been scammed.

Knowing that the area of finance makes for many pitfalls is also why she is hesitant to go into investments.

“I’m not confident to say that my motives for pursuing these things, if ever, are purely innocent,” Christina admitted. “At the moment, I think that my curiosity to know more is merely fueled by the desire to have more.”

She added: “Right now, I’m satisfied with being content with what I have. Money has always been a stronghold for me since young due to my childhood experiences, so for me to be able to reach this point – it’s a breakthrough.”

As our three friends have shown, financial management can come in different shapes and forms.

Whether you’re saving or investing, using credit cards or debit cards, there is no one-stop solution because we all have different liabilities, risks appetites and financial goals.

And remember, financial planning isn’t just all about accumulating more money.

Whether you save or you invest, it is important that we honour God with our wealth and give Him the first and best of everything we have (Proverbs 3:9).

Happy #adulting!

- On a scale of 1-10, how well are you managing your finances?

- Based on the article’s tips and handles, what is one practical thing you can do towards financial stewardship?