With the GST hike coming into effect, I know of quite a few friends around me who are gearing up for it — they’ve bought what they needed in advance last year and are preparing for fewer social activities to save costs.

So since everyone is talking about money these days, I thought I would share some tips from what I’ve learnt thus far on how we can be better stewards of our financial resources.

#1 Review your expenditure

Sometime in the middle of 2022, I began to realise that my bank account balance was going lower and lower.

I’ve always considered myself rather thrifty, so I was shocked to find out that so much money was gone without my conscious knowledge. Had I fallen prey to some scam?

My brother recommended that I begin tracking my expenses, either through an application or with an Excel spreadsheet.

After just two months of tracking my expenses, I realised that I had been overspending indeed! The main culprit was going out with friends too often.

Using money tracking applications is a great way to be aware of where our money is going.

You can even categorise your expenditure — whether that’s food, family, clothes or bubble tea — so that you know what is the main culprit!

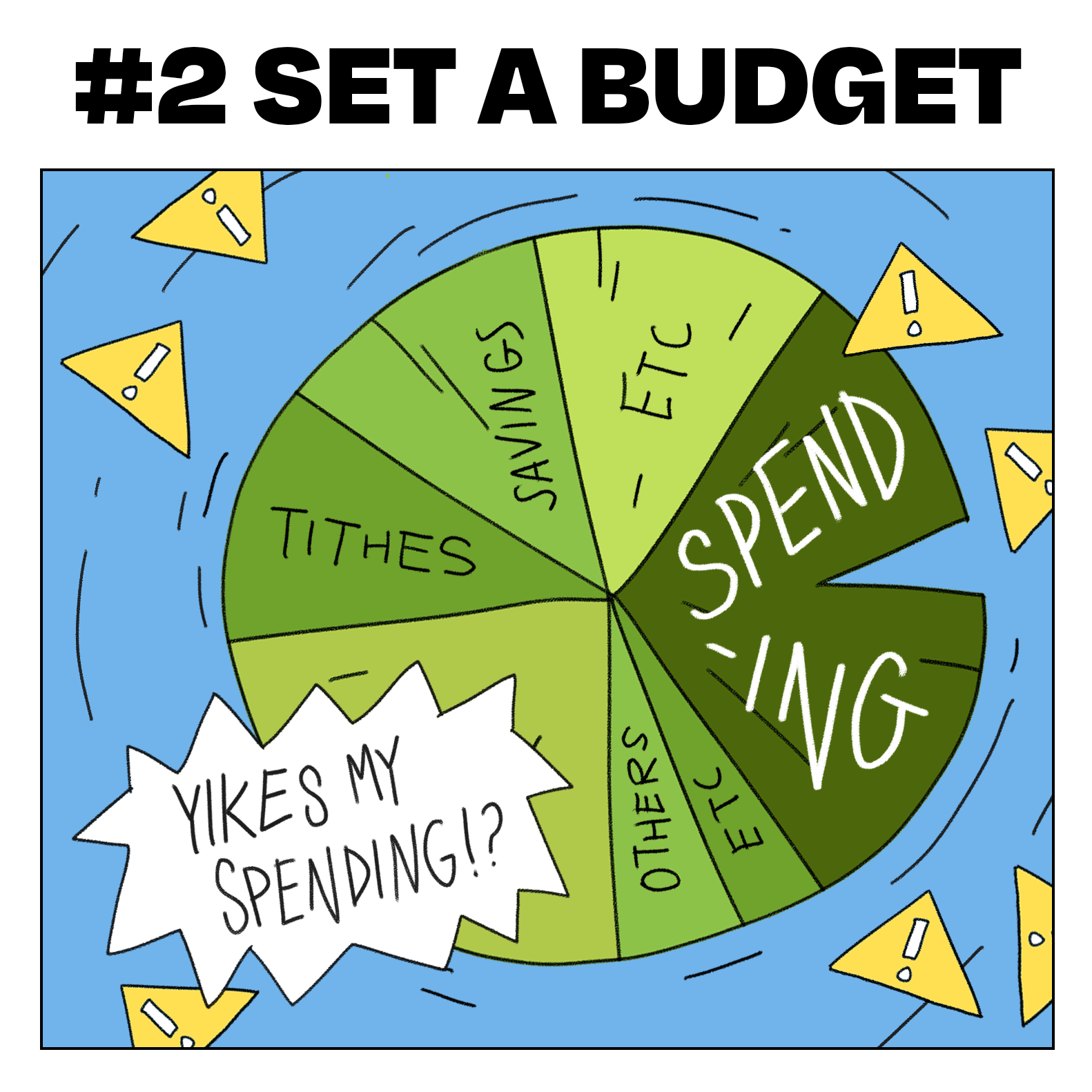

#2 Set a budget

Setting a budget for yourself is also another great step towards prudence.

The money tracking app that I used had the option to view my expenditure in the form of a pie chart. That was really useful for helping me visualise which category I spent the most money in.

Once I realised that I had overspent on social gatherings, I began to use more discernment in accepting offers to hang out.

I set a budget and promised myself that I would cut down on social gatherings in the next few months.

I used to spend 50% of my expenditure on social gatherings, but now that has decreased by 20% thanks to the budget!

Of course, there are exceptions when it comes to setting budgets.

During peak periods or holidays, we will naturally spend more on gifts or outings. We can choose to adjust our budget during such occasions — but not too frequently!

Choose only the important and significant occasions like a family member’s birthday, for example.

For the rest of the “off-peak” periods throughout the year, we should try as much as possible to stick to the budgets we set, so that we can have more leeway to spend when important occasions and opportunities arrive such as blessing others in need.

#3 Differentiate between needs and wants

If we’re serious about saving money, it’s really important to differentiate between our needs and our wants.

For example, while food is a basic necessity, where we choose to eat matters as well.

Continuously eating at expensive restaurants with friends will definitely burn a hole through our wallets, and it’s not necessary to always eat out at such places.

There’s no harm eating caifan at the hawker centre or going for cheaper alternatives more often.

Are you willing to wait before you spend? The best decisions are always made with enough time and consideration.

Moreover, with social media, food promotions and good deals are often easily made known to the public with a simple search online.

Even though we might feel shy or embarrassed to say that we’re saving money, truly good friends who care for you will never mock you for that (as long as prudence doesn’t become stinginess!).

Instead, they will support you and help you to build these good habits. So don’t be afraid to suggest alternative food places which can actually benefit everyone — there’s no shame in that.

Additionally, when it comes to differentiating wants from needs, it’s good to know that not everything that we desire is worth spending on now.

I once wanted a denim jacket that was lightweight and stylish. But all the ones I had shortlisted were around $50 and above, a price I was not willing to pay, even though many of my peers told me it was a good “investment”.

I decided to take the advice of my family and a few other friends, which was to wait and continue searching for cheaper options instead of spending my money hastily.

Eventually, while overseas with my family, I managed to get a good quality and lightweight denim jacket for just SGD $35!

Looking back, I have no regrets waiting seven months for the jacket. The waiting process also helped me practise self-control.

Are you willing to wait before you spend? The best decisions are always made with enough time and consideration.

#4 Keep on keeping on

Sometimes, the excitement of starting a new habit dies down after reality kicks in.

It’s easy to lapse back into our old habits of spending before a new one (saving) is firmly established.

Craig Groeschel has a principle when it comes to praying with your spouse: If you miss one day, don’t miss another.

Using that same principle, if we fail to meet our financial goals that month, we don’t have to wallow in self-pity or give up altogether.

We can always try again, reinforcing our actions each time until they develop into habits.

Good habits require consistency. If we truly desire a change in the way we handle our finances, then we must not give up easily!

Ask the Lord for perseverance in stewarding our money well. Stay accountable on this matter to trust friends and family — better still, practice saving money together as a group!

There’s no better time to start cultivating good habits than right now.

The habit of saving money can teach us how to be accountable with the finances God has given us, so that we don’t spend it recklessly but mindfully, knowing that every cent comes from God.

Ultimately, the wisest thing we can do with our money is to submit it to Him.

When we are faithful in stewarding whatever God has entrusted us with, I’m sure He will provide for us in ways we could never fathom in 2023.

- How’s your monthly expenditure looking like?

- What are some things you can spend less on?

- How can you raise your standard of giving?

- Meditate on Matthew 6:26-27. What does resting in God’s promise for you look like today?